Be happy, healthy, and financially wise for life.

Choose from the many ways BayPort Credit Union can help… now and well into the future. We're ready. Are you?

Join BayPort

We aim to be your long-term partner.

Credit Card & Loan Rates

Pre-qualifying is pre-tty easy!

Find your best loan rate without affecting your credit.

See your personalized offers for a car loan, personal loan, or even a credit card in minutes! Plus, getting to know your buying power pays off by saving you money in the long run. Don’t wait!

Get my rateHome Equity Line

4.99% APR* Promotional Rate for 12 Months

For a limited time, receive 4.99% APR* home equity line of credit promotional rate for 12 months once an advance has been made between April 1 – July 31, 2024.

*Certain restrictions apply. As of March 31, 2024, rates following the promotion period are 6.99–11.54% based on creditworthiness. Call or check website for updated rates. If automatic payments stop, the rate will revert to the original rate.

More about home equityHigh Yield Checking Account

Cha-ching! Say hi to 5%

Earn 5% APY* High Yield Checking2 on average daily balances up to $15,000 or 3% Cash Back Checking2 on debit card purchases. Plus, get paid up to three days early and free access to your credit score & report.

*APY = Annual Percentage Yield

More about checking accountsWhat's new at BayPort?

Three Newport News Corporations Reaffirm $500,000 Commitment to Education & Workforce Development

46 days ago

Announces Second Accelerating Change Together Grant Application Funding Today, the BayPort Foundation, Ferguson, and Newport News Shipbuilding, a division of HII, have announced a community partnership to fund a three-year,......

Three Newport News Corporations Reaffirm $500,000 Commitment to Education & Workforce Development

46 days ago

Announces Second Accelerating Change Together Grant Application Funding Today, the BayPort Foundation, Ferguson, and Newport News Shipbuilding, a division of HII, have announced a community partnership to fund a three-year,......

BayPort Credit Union Names New Executive Vice Presidents

2 days ago

BayPort Credit Union has announced key leadership promotions within the organization. Chief Operations Officer Jennifer Coyne and Chief Financial Officer Lewis Smith, respectively, have been promoted to Executive Vice President......

BayPort Credit Union Names New Executive Vice Presidents

2 days ago

BayPort Credit Union has announced key leadership promotions within the organization. Chief Operations Officer Jennifer Coyne and Chief Financial Officer Lewis Smith, respectively, have been promoted to Executive Vice President......

America Saves Week 2024

27 days ago

Starting Monday, April 8th… Dedicate this week to pause and do a financial check-in. Each day on Facebook, we’ll share a new way you can increase your savings to become more financially......

America Saves Week 2024

27 days ago

Starting Monday, April 8th… Dedicate this week to pause and do a financial check-in. Each day on Facebook, we’ll share a new way you can increase your savings to become more financially......

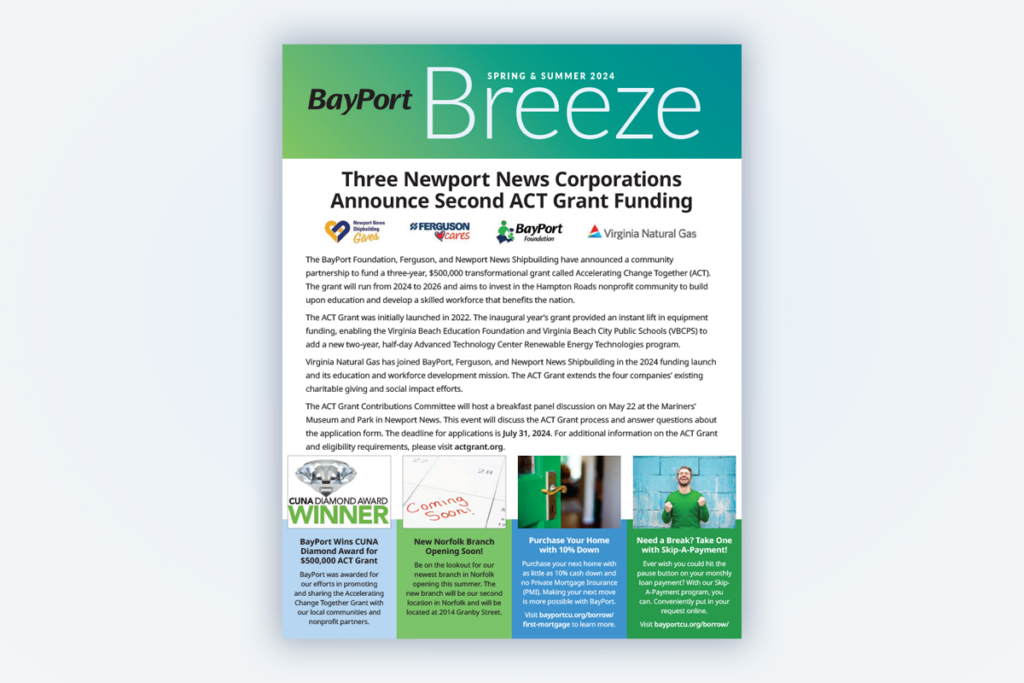

BayPort Breeze Spring/Summer 2024

30 days ago

Your quarterly newsletter has helpful tips, timely articles, and special offers. Stay informed on all that’s happening at BayPort. Download Spring/Summer 2024 edition (PDF)...

BayPort Breeze Spring/Summer 2024

30 days ago

Your quarterly newsletter has helpful tips, timely articles, and special offers. Stay informed on all that’s happening at BayPort. Download Spring/Summer 2024 edition (PDF)...

Well, isn't that nice to hear!

Refreshing approach!

![]()

LOVE banking with BayPort! I always feel valued, the staff is amazing, professional and knowledgeable. Anytime we’ve gone in to sit down and talk about finances, we leave happy and satisfied. It’s so refreshing to do business with people who treat you well and care.

Life made simple.

![]()

BayPort makes my life so easy! I log into the app to deposit checks and transfer money. Then, when I need to check account balances, I just swipe over to check my widget! BayPort has made life with a young family better.

The BayPort Foundation

Over $775,000 raised in the first three years.

Since the launch of the BayPort Foundation in late 2020, and through the generosity of our members and partners who share our vision, we have raised over $775,000.

The BayPort Foundation’s mission focuses on four philanthropic efforts: educational scholarships, financial literacy education, promoting family health and wellness, and hardship and emergency assistance. The Foundation builds upon BayPort’s existing charitable giving to local organizations.