No matter where life takes you, enjoy the convenience of BayPort’s modern mobile banking features.

Photo Check Deposit

Goodbye deposit slips and waiting in line. Snap a quick picture with your phone to deposit anytime, anywhere.

Transfer Money

Safely move money between BayPort accounts + connect accounts you have with other financial institutions.

Pay Bills

Schedule bill payments for all your expenses directly from your BayPort checking account with Bill Pay.

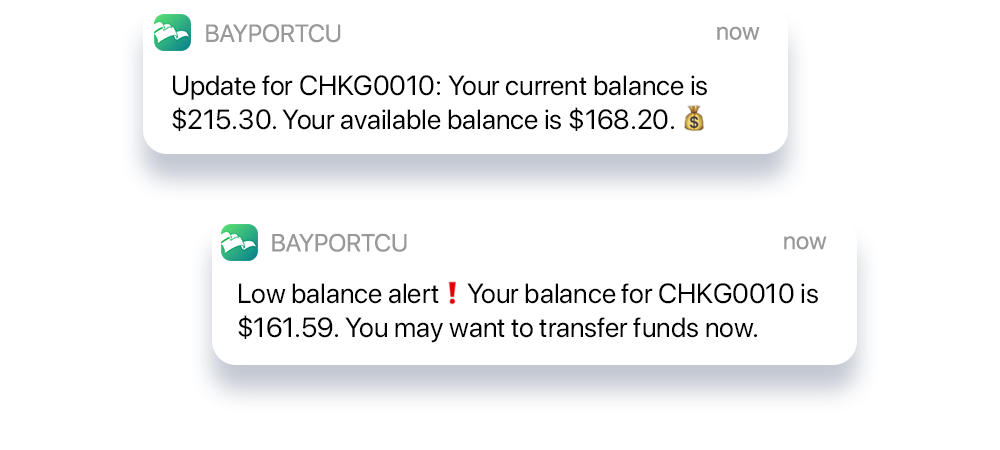

Mobile Alerts

Customize your account alerts to inform you via text or email about balances, transfers, payments and other transactions.

Turn your BayPort cards on and off, receive automatic alerts for suspicious activity, and set controls for debit or credit card usage free within Mobile and Online Banking.

Use Zelle® within our Mobile Banking app to send money directly from your bank account to a friend or family member’s bank account in minutes1. More about Zelle

Make secure purchases in-store or online with Apple Pay®, Samsung Pay®, Google Pay™ or Mastercard® Click to Pay. And, since these mobile payment services replace your card number with a unique digital number, businesses don’t see or store your full card number. Clever.

Credit Score is a free service offered to BayPort members that shows your latest score, gives you an understanding of the key factors that impact your score, and offers ways we can help you save money and reduce interest costs.

![]()

BEST APP EVER AND SO EASY TO USE! YAY!!!!! I LOVE MY BAYPORT BANK! Using this Credit Union and having their flex card has helped to improve my credit rating!

![]()

This app is very informative and extremely easy to use, I travel a lot with my job so I’m always doing my banking online and I have been very happy with my experience.

Download our Mobile Banking app after you join BayPort. Simply choose the banking product that’s right for you–savings, checking, or even one of our rewarding credit cards. Start your journey toward being happy, healthy, and financially wise for life!

Use promo code JOINUS

Never logged in before? To access Online Banking, use your account number and STAR PIN (personal identification number). Then, you’ll be prompted to create a username and password. If you haven’t set up a STAR PIN yet or need help logging in, give us a quick call at (757) 928-8850.

1 Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.